Not known Details About Pvm Accounting

Not known Details About Pvm Accounting

Blog Article

An Unbiased View of Pvm Accounting

Table of ContentsLittle Known Facts About Pvm Accounting.The Ultimate Guide To Pvm AccountingOur Pvm Accounting PDFsThe Ultimate Guide To Pvm AccountingAll About Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.Some Known Details About Pvm Accounting

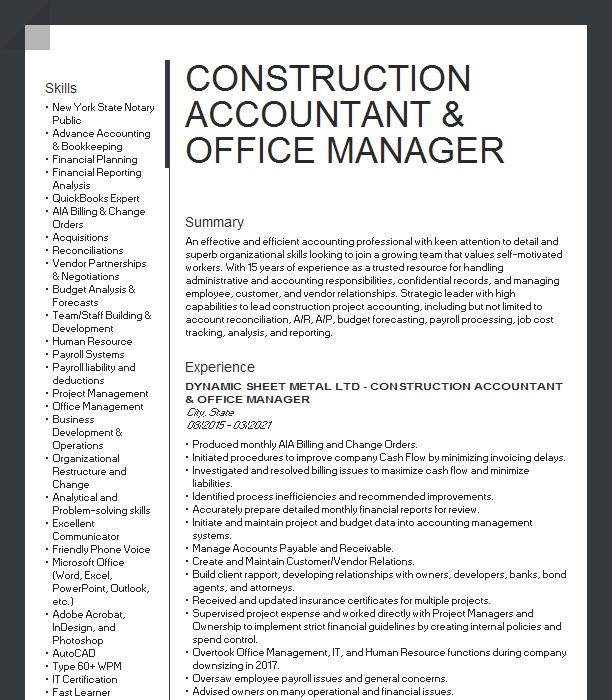

In regards to a business's total technique, the CFO is liable for guiding the firm to meet monetary objectives. A few of these approaches could entail the company being acquired or purchases going ahead. $133,448 annually or $64.16 per hour. $20m+ in yearly profits Specialists have evolving requirements for office managers, controllers, accountants and CFOs.

As a service grows, accountants can free up more staff for various other business responsibilities. As a construction firm expands, it will require the help of a full time monetary staff that's taken care of by a controller or a CFO to manage the business's finances.

Pvm Accounting - Truths

While big businesses may have full-time financial backing groups, small-to-mid-sized organizations can hire part-time accountants, accounting professionals, or economic advisors as required. Was this article helpful? 2 out of 2 people located this useful You voted. Change your answer. Yes No.

As the building and construction industry remains to grow, companies in this sector should preserve strong financial monitoring. Effective accountancy practices can make a substantial difference in the success and growth of building firms. Allow's discover 5 crucial bookkeeping practices tailored especially for the building and construction sector. By applying these practices, construction businesses can improve their monetary stability, streamline operations, and make informed decisions - construction accounting.

In-depth quotes and budget plans are the foundation of construction project monitoring. They aid steer the job towards timely and profitable completion while protecting the interests of all stakeholders included. The vital inputs for job price estimate and budget plan are labor, materials, tools, and overhead expenses. This is normally among the largest costs in building tasks.

The smart Trick of Pvm Accounting That Nobody is Talking About

An accurate evaluation of materials needed for a task will certainly aid ensure the required materials are bought in a prompt way and in the right quantity. An error below can lead to wastefulness or hold-ups as a result of product scarcity. For a lot of building and construction jobs, equipment is needed, whether it is bought or rented out.

Don't fail to remember to account for overhead costs when estimating job prices. Direct overhead expenditures are particular to a job and might consist of short-term rentals, utilities, fence, and water materials.

Another variable that plays right into whether a task achieves success is a precise price quote of when the project will be completed and the relevant timeline. This quote helps make certain that a project can be finished within the assigned time and resources. Without it, a project might lack funds prior to completion, triggering prospective work blockages or desertion.

Not known Incorrect Statements About Pvm Accounting

Exact job setting you back can aid you do the following: Understand the success (or lack thereof) of each job. As job costing breaks down each input into a job, you can track success independently. Contrast actual expenses to price quotes. Taking care of and assessing estimates enables you to much better cost tasks in the future.

By determining these products while the task is being finished, you stay clear of shocks at the end of the task and can deal with (and hopefully avoid) them in future projects. Another tool to help track work is a work-in-progress (WIP) routine. A WIP routine can be completed monthly, quarterly, semi-annually, or every year, and includes job data such as agreement value, costs incurred to day, complete approximated prices, and total job invoicings.

The 25-Second Trick For Pvm Accounting

It also provides a clear audit path, which is crucial for economic audits. construction taxes and compliance checks. Budgeting and Projecting Tools Advanced software program offers budgeting and forecasting capacities, enabling building and construction business to plan future tasks a lot more accurately and handle their financial resources proactively. Document Management Construction jobs include a great deal of documentation.

Boosted Supplier and Subcontractor Administration The software can track and take care of repayments to suppliers and subcontractors, making certain timely repayments and keeping good relationships. Tax Obligation Prep Work and Declaring Bookkeeping software can assist in tax preparation and declaring, making certain that all relevant financial activities are precisely reported and tax obligations are submitted on time.

The Buzz on Pvm Accounting

Our client is an expanding development and construction firm with head office in Denver, Colorado. With multiple active construction work in Colorado, we are trying to find a Bookkeeping Aide to join our team. We are looking for a full-time Bookkeeping Aide that will be accountable for providing functional support to the Controller.

Receive and examine everyday invoices, subcontracts, change orders, acquisition orders, examine demands, and/or other associated paperwork for efficiency and conformity with financial plans, procedures, spending plan, and contractual requirements. Precise processing of accounts payable. Enter invoices, authorized draws, order, and so on. Update regular monthly analysis and prepares budget pattern records for construction projects.

Facts About Pvm Accounting Uncovered

In this guide, we'll look into various aspects click this site of building and construction accounting, its importance, the standard tools made use of around, and its duty in construction jobs - https://www.intensedebate.com/profiles/leonelcenteno. From financial control and cost estimating to cash flow administration, explore how accountancy can profit building projects of all scales. Building accountancy refers to the specific system and processes utilized to track monetary details and make tactical decisions for construction companies

Report this page